Why is Whole Life Cost Important for Moving and Handling Equipment?

10 Minute Read

Whole life cost is spoken about in many industries and is often adopted by organisations who have a long term interest in what they are purchasing and want the best value for their budget.

Using whole life costing can help you understand and factor in all the ongoing costs involved when making up-front investment decisions. You should apply this at a strategic level to assess the different options available or compare different supplier offerings.

What Does Whole Life Cost Mean?

Whole life cost is a technique used to consider the total costs involved in purchasing something (whether a service or a product) over a specific time. i.e. from purchase to disposal or throughout a contract.

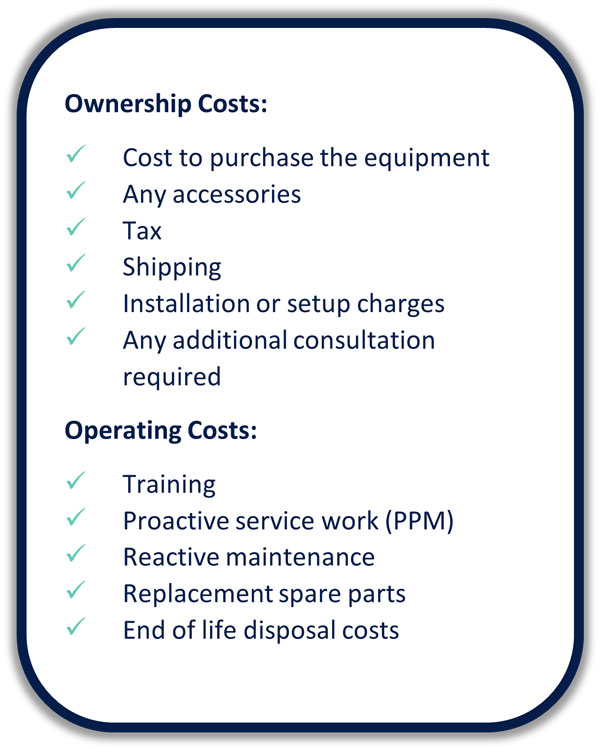

With equipment or assets, total costs include two separate components: ownership costs and operating costs.

Ownership Costs: These costs include the initial cost to purchase (or lease) the equipment and any accessories, tax, shipping, installation, or setup charges, as well as any additional consultation required.

Operating Costs: These include all the costs associated with operating the equipment during its expected lifespan, including training, maintenance and end of life or disposal costs. These costs vary depending on how much your facility uses the equipment, how it’s used and what environment it’s used in.

Maintenance and repair costs usually make up the largest amount of operating expenditure on assets. Generally, repair costs get higher as the equipment gets older and falls out of warranty. Although to counteract this, proactive maintenance and regular service visits can extend the life of your equipment and reduce your repair costs.

Facilities companies also need to factor in any likelihood of penalties and additional costs if their equipment fails and they experience equipment downtime.

Why is Whole Life Cost Important for Moving and Handling Equipment?

The cost of ownership and operating costs for medical equipment is an investment. Considering how to invest in equipment can be a burden for the healthcare industry. With tightening budgets, care facilities could risk purchasing cheap equipment because the upfront costs seem appealing. However, there are costs to consider when factoring in the ongoing and lifetime cost of the equipment.

In the MHRA, Managing Medical Devices, Guidance for health and social care organisations (3) they provide guidance on policies and mechanisms for the acquisition and selection of equipment. They recommend your procurement process should “consider whole life costs[…] where this results in the best value for money.”

In section 3.3 – Factors to consider before equipment acquisition, the MHRA says you should consider the following “In the long run, it could be cheaper to purchase a device which will last for 10 years, but it costs twice as much as a device designed to last for only 3 years, as long as maintenance and replacement parts and consumables are available for the lifetime”.

Let’s provide a basic example of this in practice:

Below provides the cost of three mobile hoists with various price ranges. One may be easier to use, feel more supportive and safe, and be of better quality. However, they will all still work to their intended purpose – to lift someone.

However, if you were to use a cheaper hoist, regularly, every day, it will probably only last you 2 – 3 years. Whereas a more expensive hoist could last you 7+ years.

From this scenario*, you can simply work out how much the hoist could cost you per year:

*This basic calculation is based on ownership cost only and doesn’t consider the operational costs of the hoist

Here you can see you might get better value over the lifetime of the equipment, by purchasing a mid-range mobile hoist vs the others. This is where you’d then weigh up the requirements for the hoist and whether it meets them.

Even though this is a simple example, hopefully, it highlights that the whole life cost considers the investment over the full lifespan of the equipment, rather than just the upfront cost.

Once healthcare organisations grasp the concept of whole life costs, it will better enable them to plan ahead of time and manage their total costs efficiently. This means you can predict when operational costs might become a burden and put lifecycle replacement plans in place.

The Benefits of Whole Life Costing

Benefits of applying the whole life cost technique include:

Non-Financial Considerations

Typically, for healthcare organisations, the focus is on the up-front costs of procuring something. Many fail to consider the longer-term costs of an asset or service.

And whilst whole life cost is important for you to get the best value from your purchase, it is also important that you consider the non-financial factors in your decision-making process, as well as unforeseen costs that are hard to calculate. For example:

Answering these questions along with the whole life cost considerations will ensure you get the best value and make the most informed decision, which will benefit your organisation in the long term.

See if you can implement the whole life cost technique into your next equipment purchase or supplier contract review.

If you have any questions or would like more guidance, please contact our team who would be happy to help.

Prolonging the Lifespan of your Equipment to Maximise Value

Another part of ensuring you maximise the value of your equipment is to look at ways to extend the lifespan of your equipment. To put it simply, the longer your equipment lasts (in good working condition), the better your investment.

As we’ve mentioned in other posts, a great way to do this is to provide regular training to your staff on the care and safe use of equipment. Some of the articles and videos below will help: